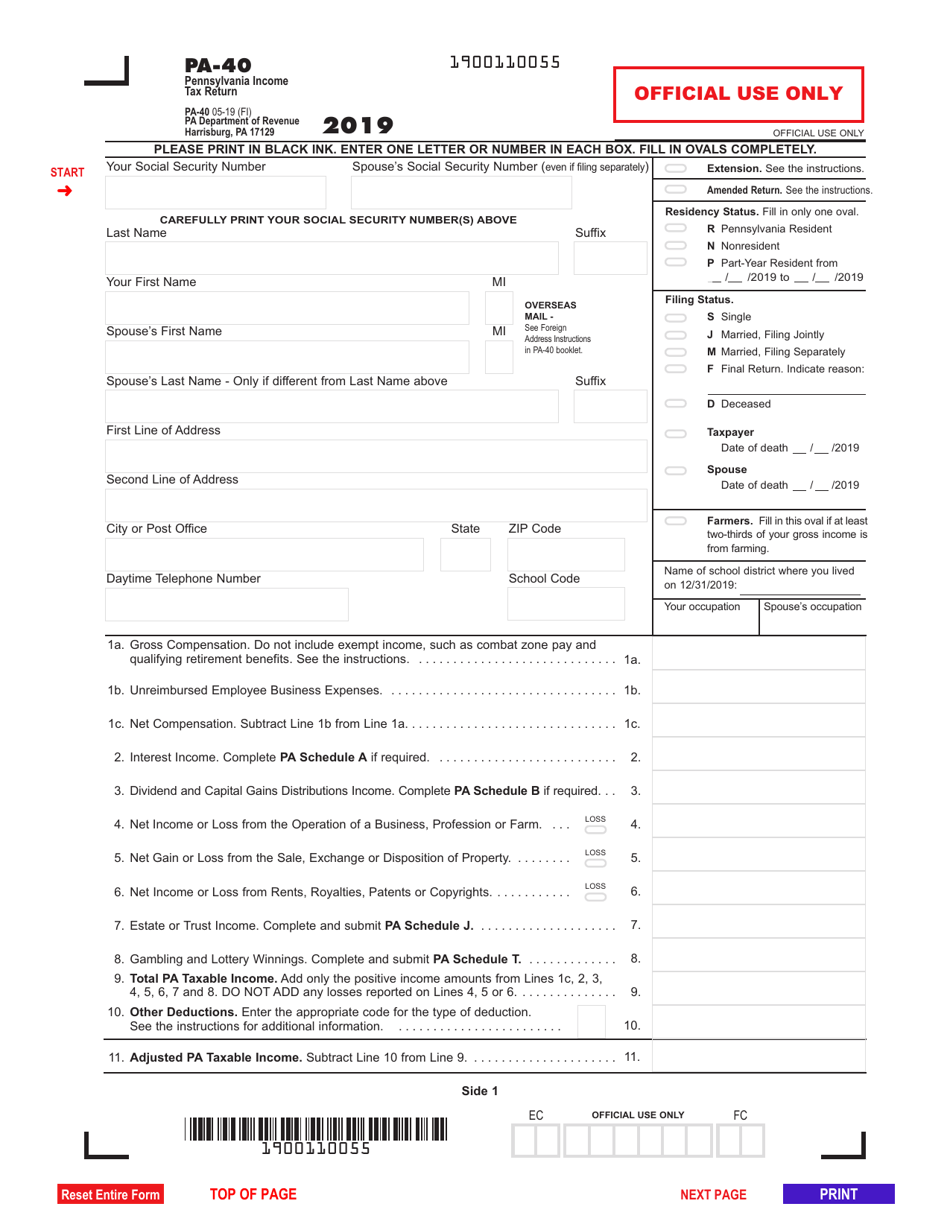

Pa-40 Tax Form 2025

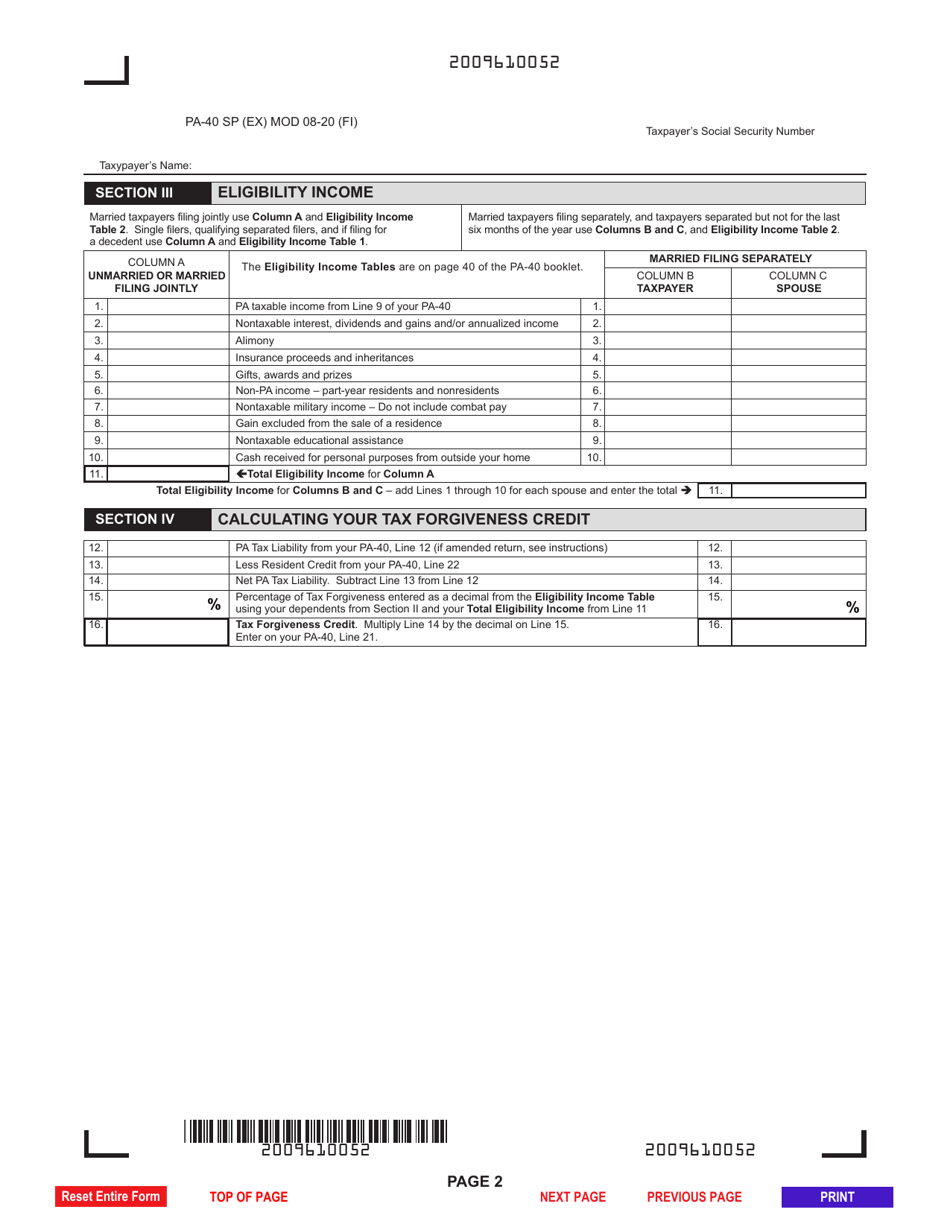

BlogPa-40 Tax Form 2025 - Pa state tax Fill out & sign online DocHub, These 2025 forms and more are available: Explain the reason for filing the amended return in section iii of the schedule. Here is a comprehensive list of pa state tax forms, along with instructions:

Pa state tax Fill out & sign online DocHub, These 2025 forms and more are available: Explain the reason for filing the amended return in section iii of the schedule.

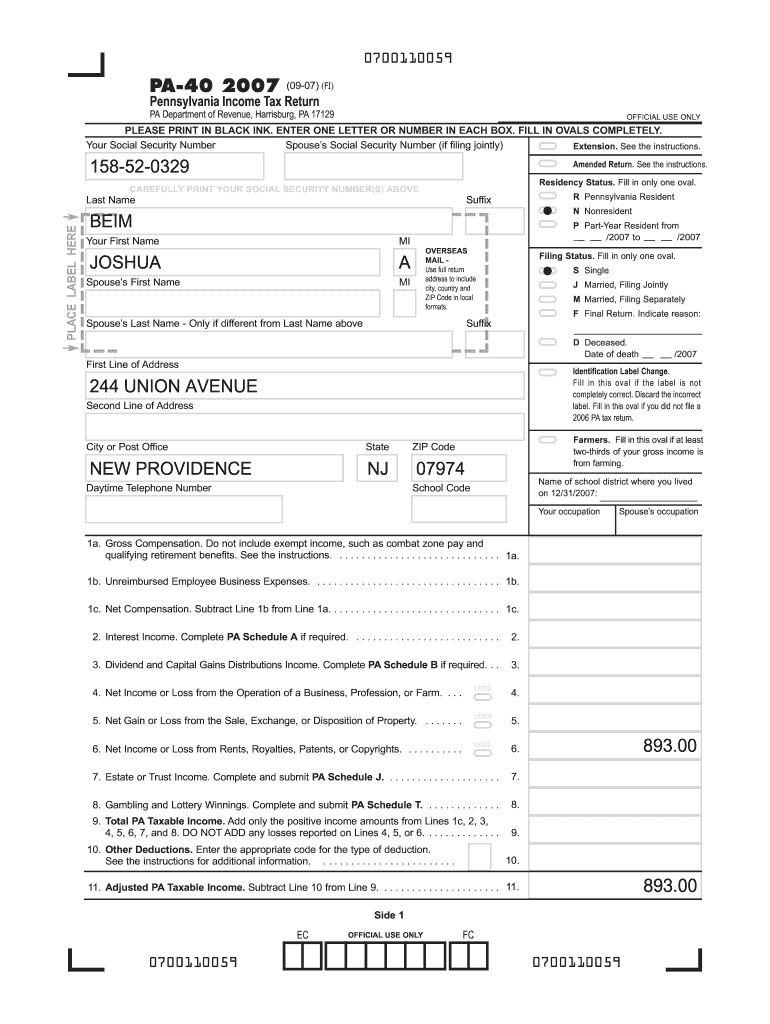

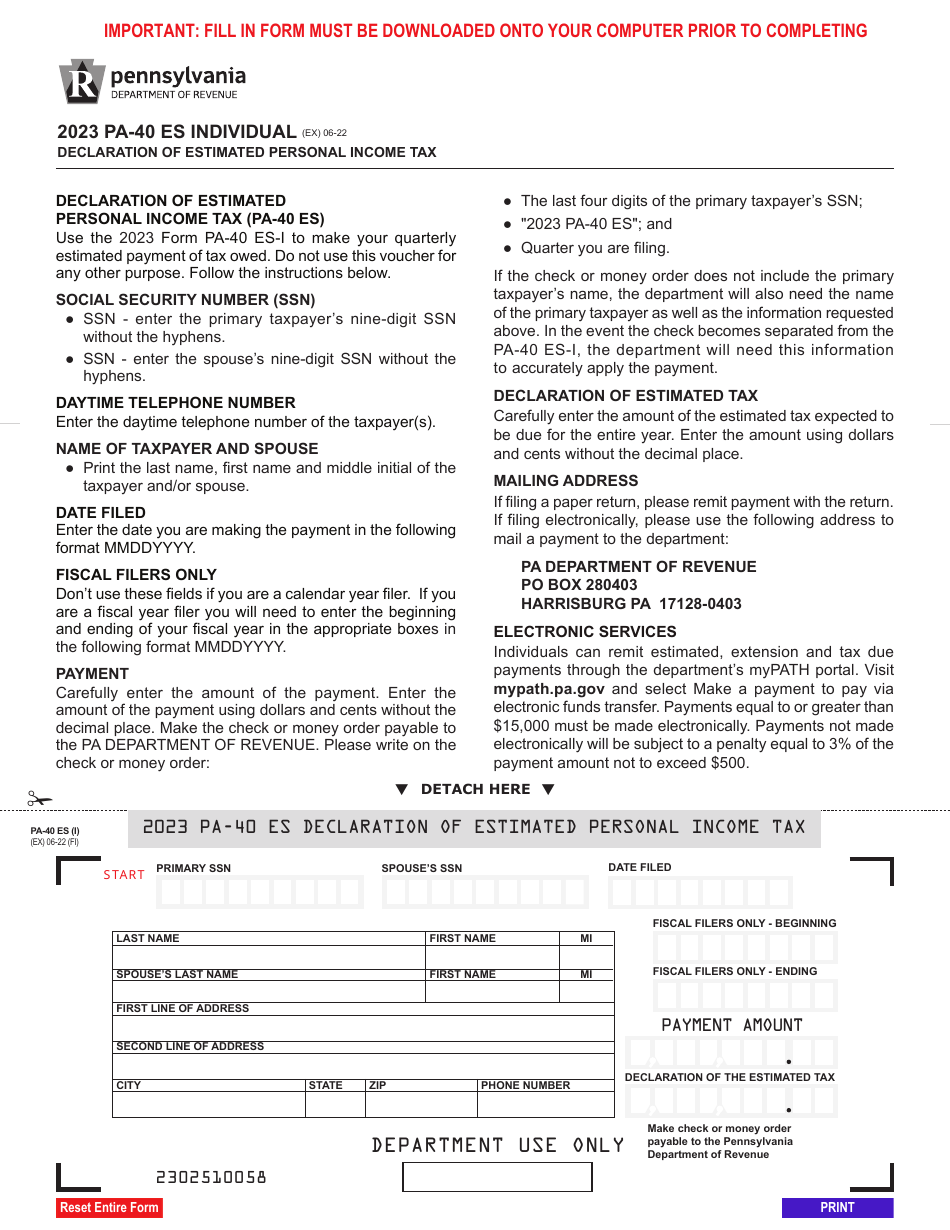

Pa-40 Tax Form 2025. Discover the pennsylvania capital gains tax and its rates in 2025. Learn how to file a pa personal income tax return for free using the new mypath portal.

Indicate the tax year you are amending (2025 in this case).

Mv 4st Fill out & sign online DocHub, Indicate the tax year you are amending (2025 in this case). You must file & pay individual income taxes in pennsylvania by april 15, 2025.

PA PA40/PA41 OC 20252025 Fill and Sign Printable Template Online, This form is used by pennsylvania residents who file an individual income tax return. You must file & pay individual income taxes in pennsylvania by april 15, 2025.

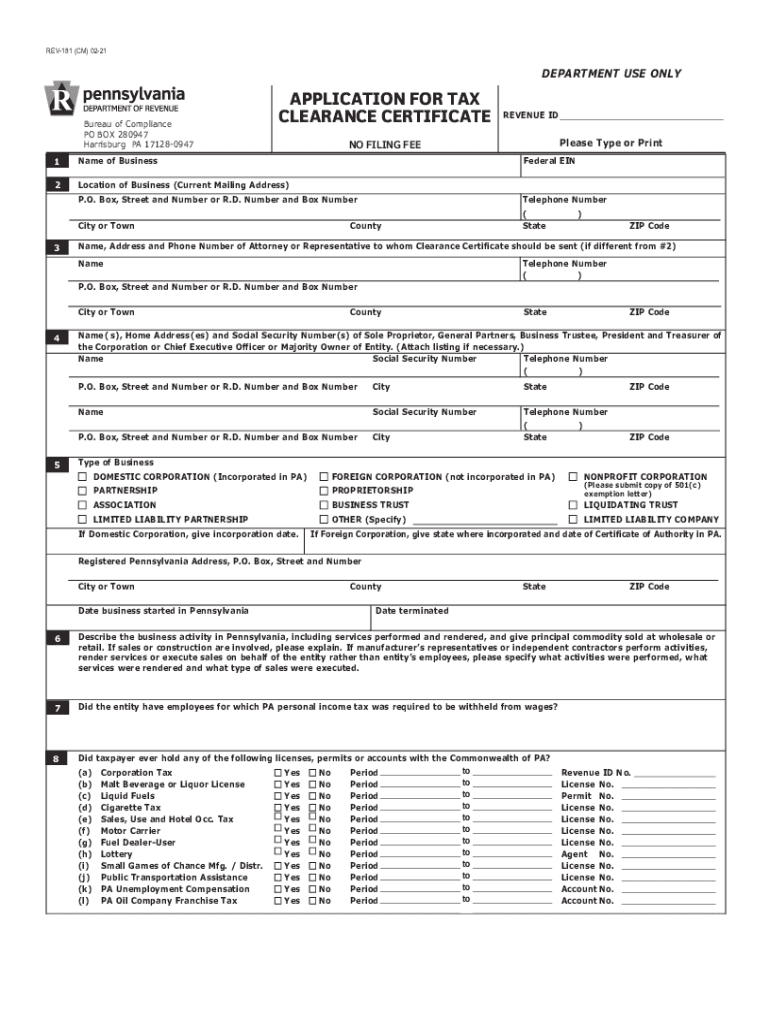

20252025 Form PA DoR REV181 Fill Online, Printable, Fillable, Blank, These 2025 forms and more are available: This form is used by pennsylvania residents who file an individual income tax return.

Pennsylvania residents state income tax tables for widower filers in 2025 personal income tax rates and thresholds (annual) tax rate taxable income threshold; Here is a comprehensive list of pa state tax forms, along with instructions:

Printable State Tax Forms, Learn how to file a pa personal income tax return for free using the new mypath portal. Pennsylvania residents state income tax tables for widower filers in 2025 personal income tax rates and thresholds (annual) tax rate taxable income threshold;

Form PA40 Schedule E Download Fillable PDF or Fill Online Rents and, Learn how to file a pa personal income tax return for free using the new mypath portal. Filing & viewing returns in mypath.

Schedule nrh compensation apportionment [for nonresident.

Indicate the tax year you are amending (2025 in this case).